I have hesitated to tell this story, NOT because it is hard to tell or lack of feeling or reluctance, but rather, because there are so many chapters to my life story, that I waited and waited for the right time, perhaps stuck in a sense that it had to be if not perfectly told, gosh, that cannot be true, but at least cover it. And now, rather than delay yet more, I chose to tell it, in short order. What is the apt phrase? ” Just do it”.

I see the benefits of my attempting to share quickly, albeit far reduced in scope or craft, but gaining by being finally shared instead of stored away for a better day:

*

START:

Both my parents were public school teachers. My father, while not highly gifted, worked at it, and over many years improved so much, that he became highly respected. He had all his lesson plans mapped out, all the tests, and knew his subject, Chemistry. He later became highly regarded, and this shows the benefit of long term application.

At the same time, we lived thirty minutes from West Caldwell, which my father was darn near forced to teach at, as he committed a very serious white collar crime, out of some mix of panic about money and probably mental illness, and had to leave his path as chemical engineer. The judge put him on parole and told him, he had to keep his nose clean or go to prison, mostly out of sympathy for my mother, who had three kids, and all 85 pound of her. I could just see her with a six year old, a two, and a two month old in court, as was suggested by his attorney. I am not ashamed, for my father learned to be a markedly honest man.

*

I was raised to be honest. Some are raised to be fighters, or lawyers or doctors of financers, but me, I was raised singularly to be honest. Lying was the worse thing. “Always speak the truth. Even if it hurts”. And with that, “if you ever have the chance to help another person, you do it”. That would be first my mother speaking, then my father.

My mother almost died when she had me. All 85 pounds of her, and a third C-section, she was told, unlikely to survive. I was a quiet baby. Not sure what happened after–vocal to this day.

She was so upset, when my father was arrested for a serious felon, that she did not want to show her face, outside our house for, for the first year that I was born. She was a third grade teacher, then a stay at home mom. Her father was a concert pianist. An expert in Bach finger technique. He was a creative genius in two areas.

You know about, ‘generational switching’ in DNA. Grandkids FAR more like grandparents than parents. My life is a gift, hard and easy. Learn how not to be all like him. Erratic. Excitable. Unstable. Manic. Driven. But very creative for sure. He also did electronics, as an early adopter.

*

I often say, that “I am the most insecure, highly confident person, that you will ever meet. It stems from these events. I entered the world in, if not severe trauma, then assuredly, deep upset. So all the study, martial arts, intellectual investigation, and even meditation, could never make me feel safe. Sorry, but it is true.

*

We finally moved from this working class town, in 1969, when riots were swelling around Newark. This was a good move, by my parents. There were excellent schools, more middle and upper middle class, safety, nearby farm land even, nested between miles of forest, in otherwise gentele suburbia.

My parents by all accounts loved each other. Their physical life, as told by both sides in modest hints, was intact, but my father could not reason with my mother, and left her, twenty years to the day, on New Years Eave, that they were married. My mother nearly lost her mind, or did. She kept a clean house and gave me three page, numbered work lists, and so when at age 12 or so, I began working, work I could do, and correctly.

Childhood:

When my father left, he left his drawing instruments behind, and I was, viola, nearly all but an architect in a matter of weeks and months. I just knew. I started designing houses, cities, cars, ships, roadways. Cartoons. So that when I took drafting in tenth grade, I did the entire three year curriculum in two months was it. The teacher, Mr. Lacik, told my mother: “I cannot teach him. He can do whatever he wants”.

I also started running, at age twelve, till recently just missing fifty years of effort–heart disease now, remarkably.

College:

I signed a lease, renting an apartment at age seventeen. Although I was attracted to the opposite sex, in a normal way, I just did my work in school, did not drink or party, and was deeply focused. First love, took long to find, but of course did as it had to, nature taking it course.

I studied with John Hejduk, one of THE top theoretical architects in the world, at that time.

Asia:

I got deep into Japanology, martial arts, and took on the beginnings of formal meditation, no matter how much I pretended to be a good student, at that time.

The South:

I lived in Southern Pines, then High Point, then finally Winston-Salem, getting an architects license finally, and getting a foothold into nutrition and holistic health.

Seattle:

I HAD to get out of the south. I was not only a Yankee and never would not be, I was ONE pushy one, and the more polite southerners told me, I had to change my ways, and change I did. And got out, nearly holding my breath.

At the same time, Seattle was a mean and hard and cold grinder. I am not bitter, but for twenty years, I tried and never found love and little friendship, save some wonderful exceptions.

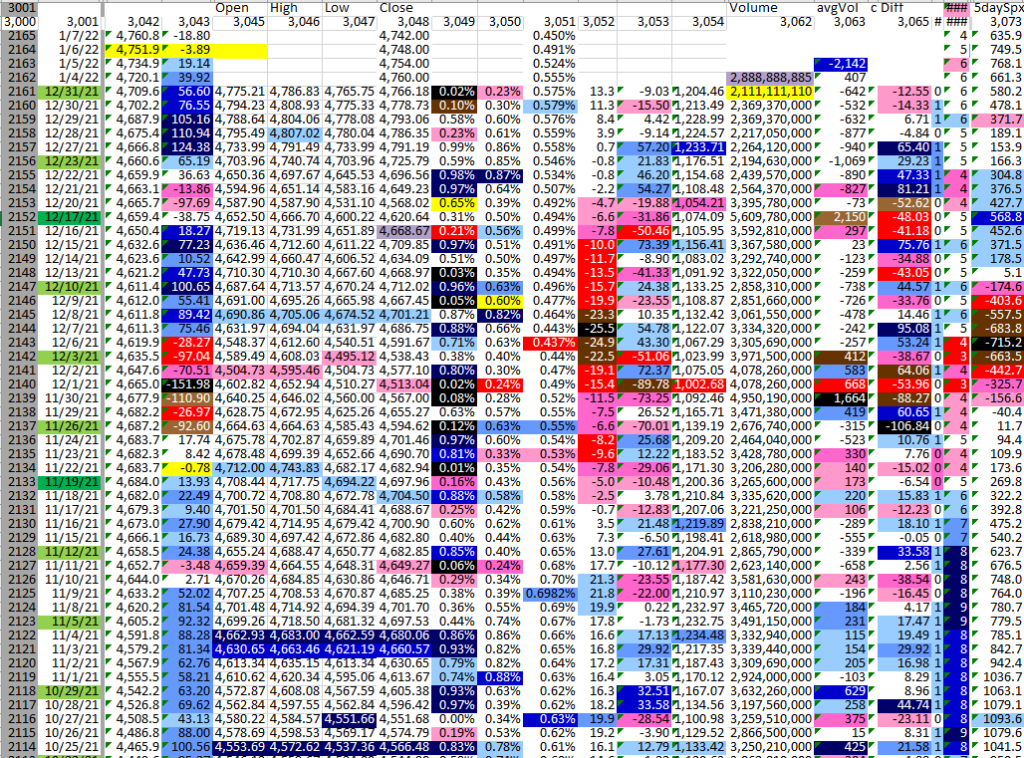

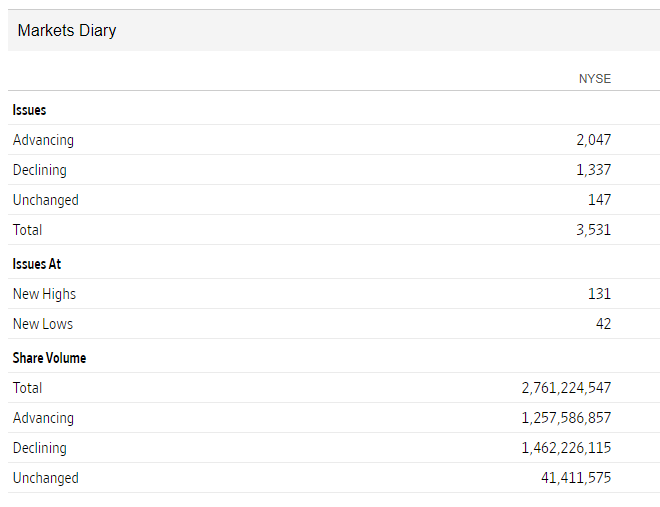

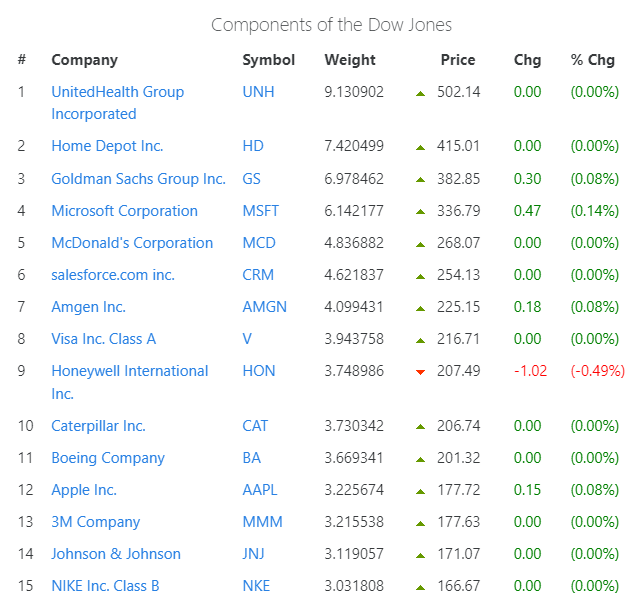

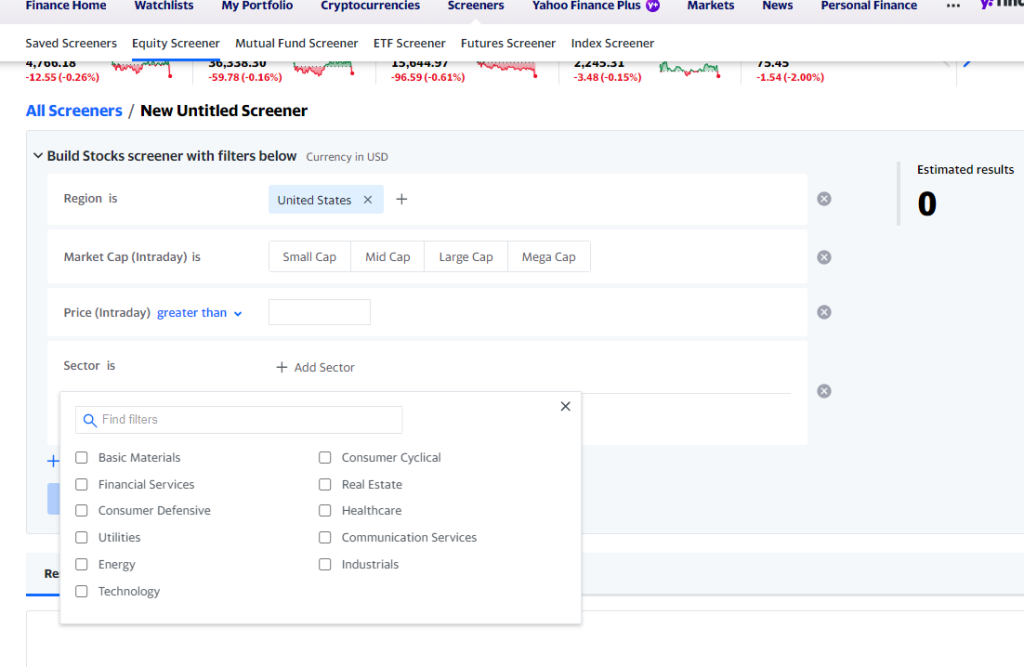

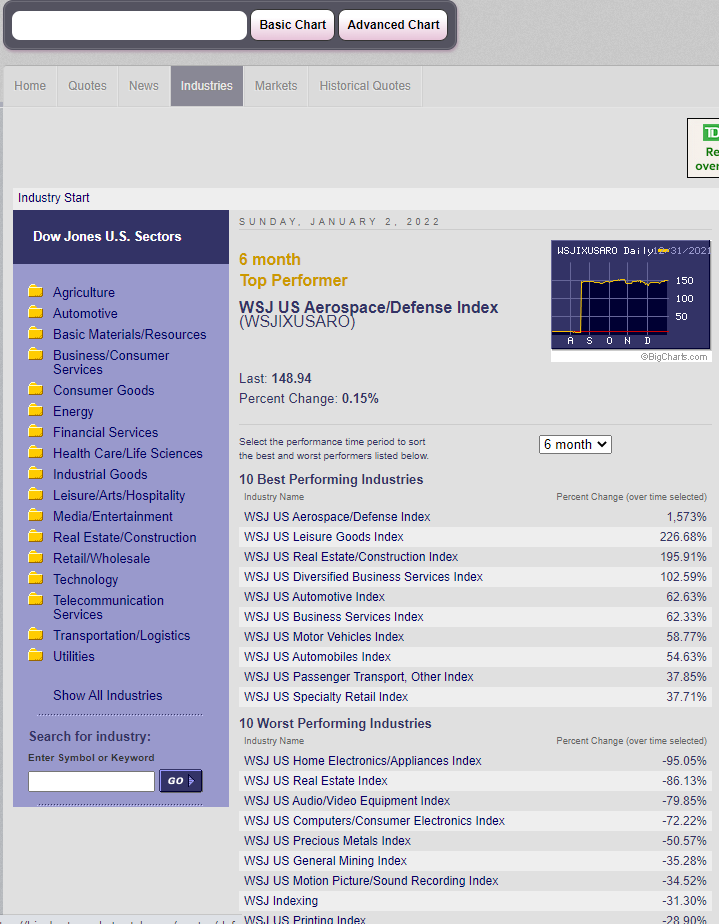

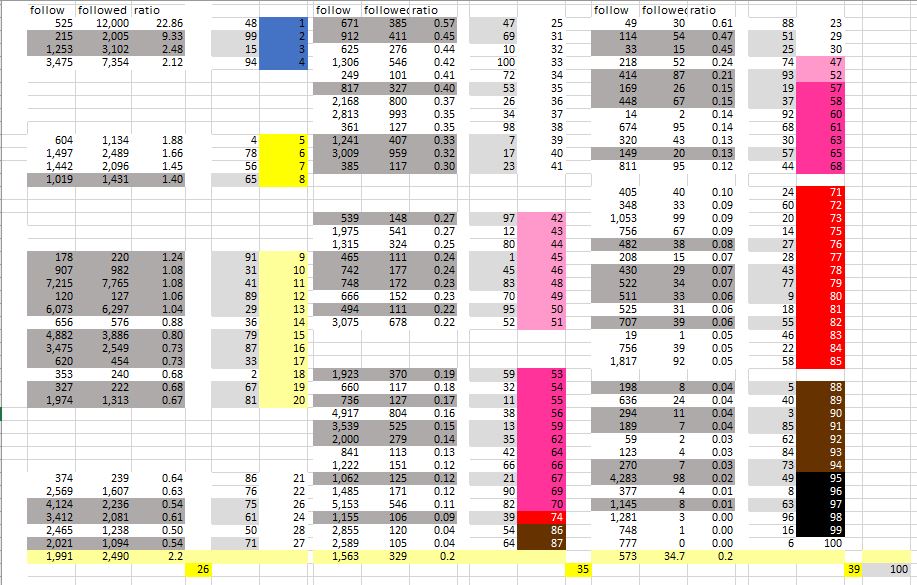

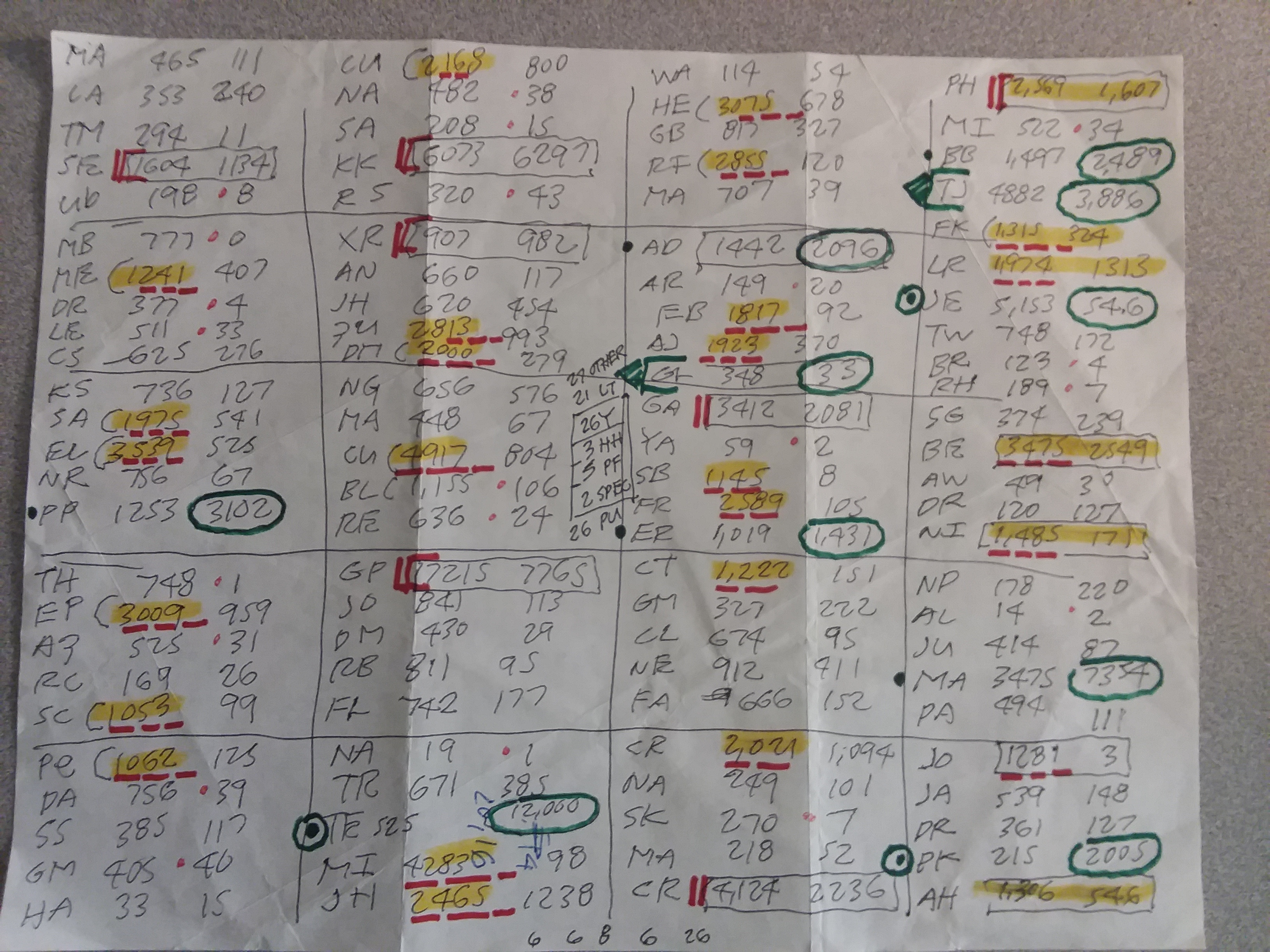

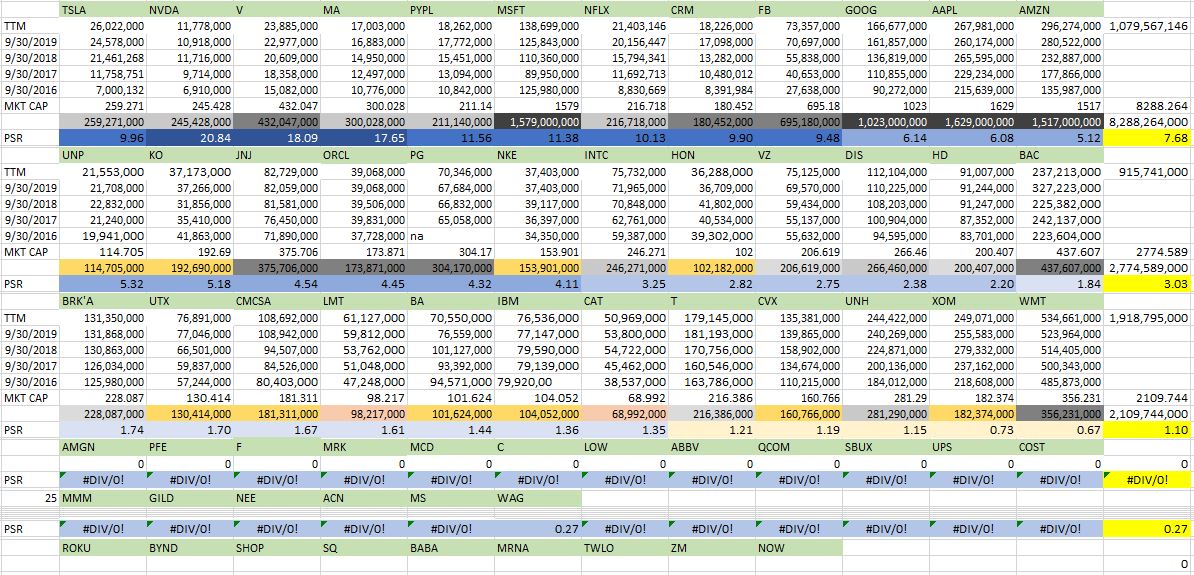

Stocks:

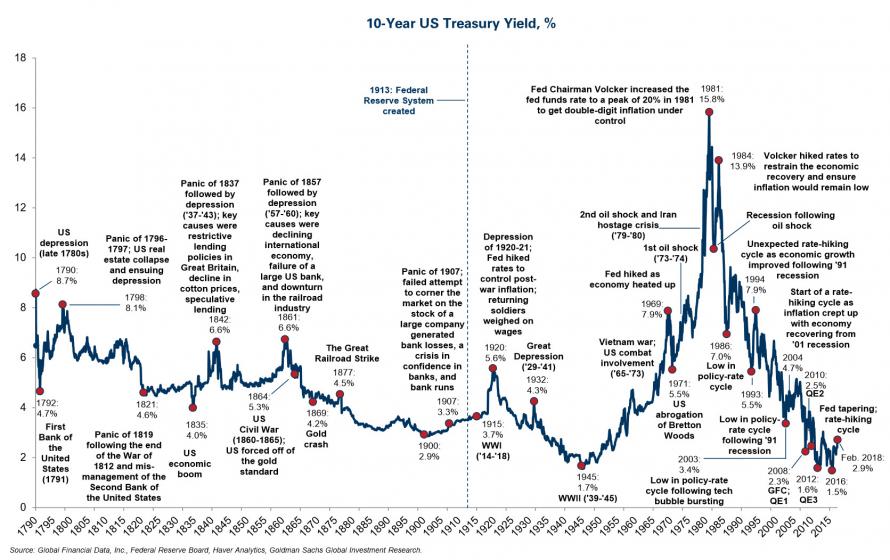

I got hooked on stocks in 1990, and now, in 2022, the fascination has not left me still.

DRAFT, Thur 13-Jan-2022, 12:34 pm. To be continued. Unrevised, substantially unchecked.

I once casually dated a wonderful woman once named J, who told me how she gave up her number one client, who generated over 60% of ALL her fees for public accounting, because she did NOT agree with how they wanted their accounting done. Talk about brass. Yet she could no longer accept things as they were, and said, let the chips fall where they may. We were not a match, and friendship was the clear outcome.

I once casually dated a wonderful woman once named J, who told me how she gave up her number one client, who generated over 60% of ALL her fees for public accounting, because she did NOT agree with how they wanted their accounting done. Talk about brass. Yet she could no longer accept things as they were, and said, let the chips fall where they may. We were not a match, and friendship was the clear outcome.